- #TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS PDF#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS MANUAL#

- #TEXAS AG EXEMPTION LAND REQUIREMENTS LICENSE#

#TEXAS AG EXEMPTION LAND REQUIREMENTS LICENSE#

*All homestead applications must be accompanied by a copy of applicant’s driver’s license or other information as required by the Texas Property Tax Code. Three of them are described in this publication-stocker calves, meat goats. While forage availability may limit the stocking rate, there are some livestock operations that can succeed on small acreages.

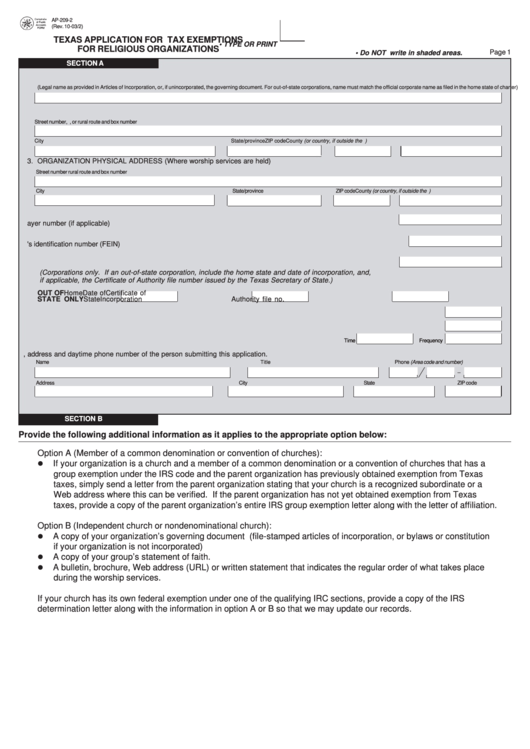

However, land within the city limits must have been. New rural landowners are often interested in establishing livestock enterprises, even when their acreages are small. Llano CAD Checklist for Organization Exemptions The land must have been devoted to agricultural production for at least five of the past seven years.Policy for Combining or Dividing Parcels.Real Property Inventory Valuation Procedures These rules, Guidelines for Qualification of Agricultural Land in Wildlife.

#TEXAS AG EXEMPTION LAND REQUIREMENTS MANUAL#

Appraisal Manual & Local Appraisal Procedures.Updated Property Tax Information Now Available for Texas Taxpayers.Real Property Inventory Property Tax Law.What you will need to apply for a Homestead Exemption.Partial Property Tax Exemptions 2022 Certified Totals.50-312 Temporary Exemption Property Damaged by Disaster Application.Wildlife Management This is the latest major change for 1-d-1 land. 131.001 the minimum number of hives will be six (6). Animal units are subjected to the breakdowns. One animal unit per 5 to 10 acres of agricultural land.

#TEXAS AG EXEMPTION LAND REQUIREMENTS HOW TO#

In accordance with the Texas Agricultural Code Sec. What Are the Requirements to Apply for an Ag Exemption in Texas If you’re interested in applying for an ag exemption in Texas, here are some of the requirements you’ll need to first meet: You must have agricultural land of 10 acres or more. ments for landowners to qualify their land for agricultural appraisal and instructs appraisal districts on how to appraise qualified agricultural land.

Cow/ calf The operators of a cow/calf enterprise are in the business of raising beef for sale to. Taxing Unit Disaster Exemption Presentation uses for 1-d-1 land and the requirements for each.Tax Payer Disaster Exemption Presentation.Citizen’s Comments and Public Participation Form.ARB Citizens Comments Public Participation Form.apply plant food, fertilizer and agricultural chemicals in producing crops or. Timber 400 trees/acre Wildlife Exemption in Texas - Plateau Land & Wildlife Management - Ag Valuation - Texas Beekeeping You can consume it or gift it. There are many options when it comes to providing supplemental food for targeted wildlife. Land in Wildlife Management use, Texas Comptroller of Public Accounts, Property. The use of food plots should only be considered as supplement to the native habitat. The rules have been added to the Guidelines for Qualification of Agricultural. The Manual for the Appraisal of Agricultural Land, Property Tax Division, Comptroller of Public Accounts, April 1990, supports these This includes: Raising stock, poultry, or fish. The rollback tax is due for each of the previous five years in which the land received the lower appraisal. 30.270 Acres, 2463 FM 949 These guidelines will be revised in the future to accommodate changes in law, circumstances or in light of new information. There might be a very rare exception but barns, honey housesand any permanent structure will be appraised at market value. As a farm, in Texas you may be required to file a General Personal Property Rendition form with your appraisal district each year by April 15th. 1768 = $335.13, rounded off to $335 per acre, Making census counts to determine population. How to Reduce Property Taxes on Open Space Land and Agricultural Land in Texas, Texas Parks and Wildlife (TPWD) Biologist, Land and Ranches for Sale in Colorado County, TX, how much can you save on property taxes in Texas with ag land, how to designate your land as ag use in Texas, how to get ag exemptions on land in texas, how to qualify for wildlife management tax exemptions in Colorado County Texas, how to qualify for wildlife management tax exemptions in Texas, how to qualify land as open space in Texas, how to use bees to qualify for ag exemptions on land in Texas, what is minimum acres required to qualify for ag exemption on property taxes in texas, what is the difference between open space land ag use land in texas, when should you use open space versus ag use in Texas, Five-year average of net to land = $315.92, Gross Productivity Value ($315.92/.1000) = $3,159.20, Maximum hives per Max Acreage = 0.6 x (12hives/20 acres), 20 acres contribution to total bee range = 17.68%, Productivity value $3,159.20 x.

#TEXAS AG EXEMPTION LAND REQUIREMENTS PDF#

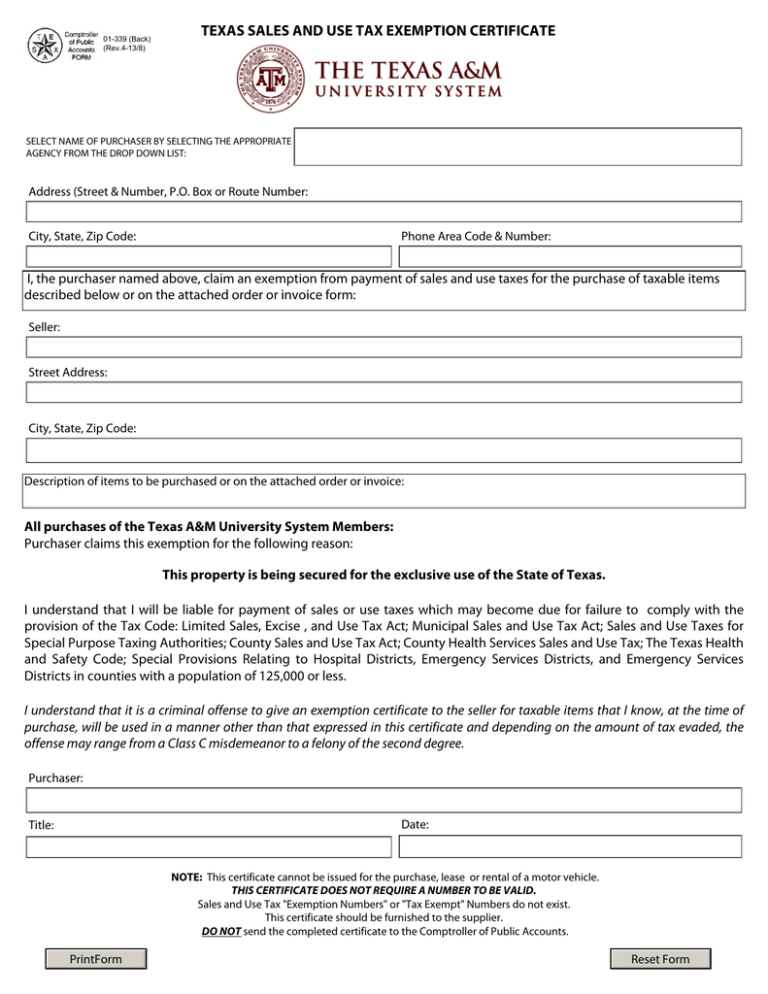

The county appraisal district forms and documents that may be downloaded from our website are in Adobe Acrobat Reader PDF format.

0 kommentar(er)

0 kommentar(er)